Customs Clearance

- SMG

- Feb 5

- 1 min read

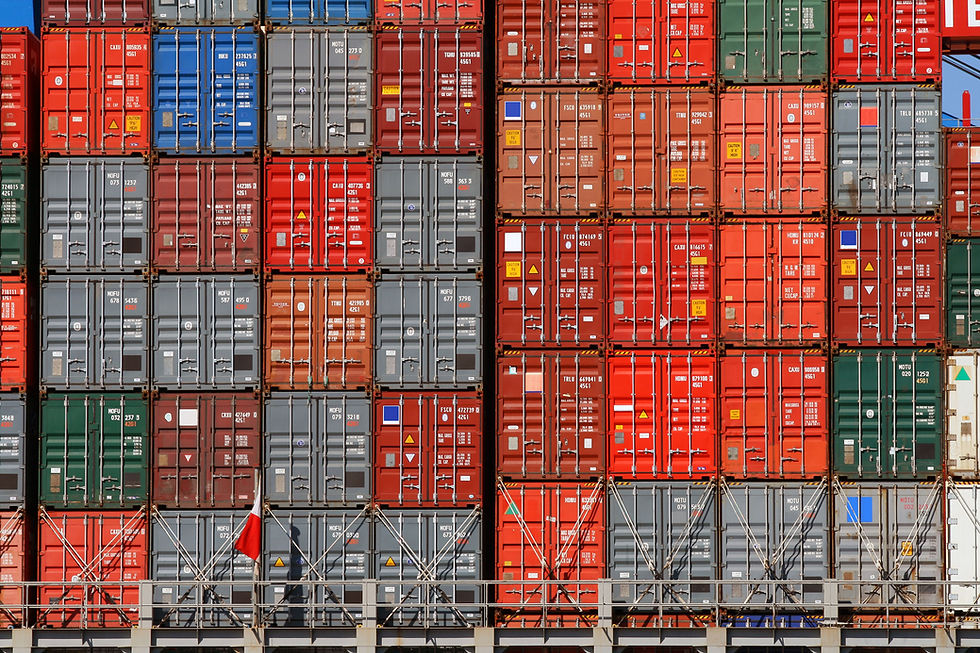

Customs clearance is a critical step in international trade, ensuring that goods comply with local regulations before entering or leaving a country. This process involves documentation, duties, taxes, and inspections to facilitate smooth import and export operations.

Advantages of Customs Clearance:

Regulatory Compliance: Ensures shipments meet legal and trade requirements, avoiding penalties and delays.

Efficient Processing: Speeds up the movement of goods through ports and borders, reducing storage costs.

Accurate Duty & Tax Calculation: Helps businesses manage costs and avoid unexpected fees.

Risk Mitigation: Prevents issues such as shipment seizures or compliance violations.

Key Aspects of Customs Clearance:

Documentation Processing: Involves preparing necessary paperwork such as invoices, packing lists, and certificates of origin.

Customs Duties & Taxes: Proper assessment and payment of applicable fees to prevent clearance delays.

Cargo Inspection & Compliance: Verification of goods to ensure they adhere to safety and quality standards.

Challenges and Solutions:

Complex Regulations: Customs laws vary by country, requiring expertise to navigate effectively.

Delays in Processing: Working with experienced customs brokers can streamline procedures and expedite shipments.

Conclusion:

Customs clearance is an essential element of global trade, ensuring smooth and lawful transit of goods. With proper planning and professional assistance, businesses can optimize their supply chain and avoid unnecessary disruptions.

Comments